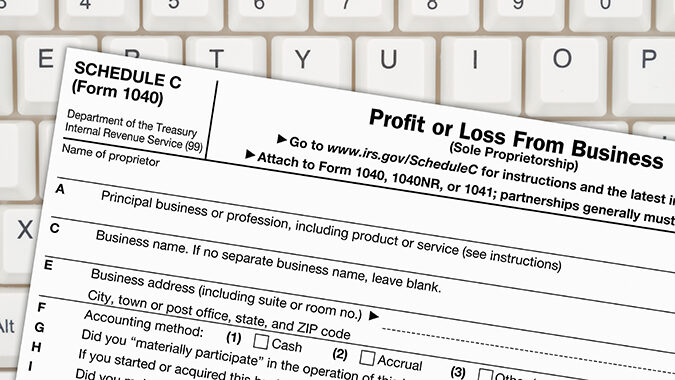

nj bait tax form

Purpose of Form PTE-200-T. The following are.

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

Pass-Through Business Alternative Income Tax PTEBAIT Petroleum Products Tax.

. An electing business must file an annual tax return Form PTE-100 to calculate its New Jersey source income and the resulting tax. New Jersey enacted the Business Alternative Income Tax BAIT in early 2020 in response to the federal 10000 limitation on the deductibility of state and local taxes. Of Taxation BAIT Extended to June 15 2022 03162022.

The legislation enables pass-through business owners to take a deduction for state and local taxes paid at the entity level creditable to an individual or corporate owners New. PTEs wishing to pay the BAIT will be required to make quarterly estimated tax payments which. This legislation generated only passing interest from the taxpaying community until the Internal Revenue Services IRSs November release of Notice 2020-75 in which it expressed a favorable view toward state-sponsored pass-through entity PTE state.

All forms and payments must be filed electronically. Im sure the OP knows more about it than I do and I dont use. That BAIT Tax sure sounded like a can of worms.

So I looked it up and it seems that New Jersey has a new way to tax Pass Through Entities with a Business Alternatives Income Tax Makes me glad I live in a state where I can pump my own gas. New Jersey residents are allowed a credit against their New Jersey gross income tax due for the amount of any state PTE tax that the director determines is substantially similar to the New Jersey BAIT. Pass-Through Business Alternative Income Tax Act.

On the bottom of the form is a box for the members share of business alternative business income tax which should be reported on the business owners new jersey personal return as a credit to offset any new jersey tax liability. If you do not have a suffix enter three zeroes. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business.

The elective entity tax. Form PTE-100 and pay the tax due. By Jason Rosenberg CPA Withum January 15 2021.

PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020. The individual members of the PTE are allowed a refundable New Jersey gross income tax credit equal to their pro rata share of the BAIT tax paid by the BTE. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022.

Pass-Through Business Alternative Income Tax Act. Your New Jersey tax identification ID number has 12 digits. Tax is imposed on the sum of each members share of distributive proceeds which is 900000.

New Jersey business owners may want to reconsider passing on the NJ BAIT election due to recent legislative change. A business can submit Form PTE-200-T to request an extension of time to file Form PTE-. March 5 2021.

An entity must first register with the New Jersey Division of Revenue and Enterprise Services to take advantage of the business alternative income tax BAIT. I have not indicated anywhere while using TT that I wanted to opt-out. Returns due between March 15 2022 and June 15 2022 are now due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments.

BAIT Extension Information. Since the passage of the legislation the NJ Division of Taxation has created and updated its Frequently Asked Questions which contain general information about the BAIT as well as information on making the election making estimated tax payments and calculating the tax. I downloaded upgrades and was told my NJ could not be filed electronically due to Returns with pass through business alternative income tax credit not eligible for electronic filing.

The NJCPA has received verbal and email confirmation from the New Jersey Division of Taxation that the due dates for the following forms are extended to June 15 2022. Public Community Water System Tax. I will post an additional problem s I found in NJ-1040 forms separately as follows.

Out-Of-State Winery License For Direct Ship Wine Sales to New Jersey. To participate the entity must file an election form annually. Members will include a copy of the Schedule PTE-K-1 with their New Jersey Gross Income Tax or Corporation.

If you have a Federal Employer Identification Number FEIN assigned by the Internal Revenue Service IRS your New Jersey tax ID number is your FEIN followed by a 3 digit suffix. I filed Federal a few days ago and my NJ was held up due to NJ-DOP not available until today. Pass-through entities that have elected to pay the Pass-Through Business Alternative Income Tax must use Form PTE-200-T to apply for a six-month extension of time to file Form PTE-100.

For New Jersey purposes income and losses of a pass-through entity are passed through to its. New Jersey is one of the latest states to enact such a SALT workaround using an entity-level tax known as the Pass-Through Business Alternative Income. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub.

Nj bait tax form. The credit cannot exceed what would have been allowed if the income was taxed at the individual level and not taxed at the entity level. 1418750 42380 900000-250000 650000 x 652 42380 5656750.

The BAIT tax rate ranges from 5675 distributive share under 250000 to 109 distributive share over 5 million. Instructions for Pass-Through Business Alternative Income Tax Application for Extension to File Form PTE-100. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

The New Jersey pass-through entity tax took effect Jan. In January 2020 New Jersey enacted the Pass-Through Business Alternative Income Tax BAIT. NJ-1040 is not printed out for review AND NJ-1040 indicates a tax preparer was involved WAS NOT and the tax preparer and I are opting out of filing electronically.

Starting with the 2021 reporting year the BAIT computation begins with New Jersey taxable income and results in better alignment with the owners New Jersey tax liability. Using the table above tax is calculated on the 900000 as follows. They must also pro-vide Schedule PTE-K-1 to each member reporting the amount of the members share of distributive proceeds and Pass-Through Business Alternative Income Tax.

Call the division of revenue and enterprise services 24000 400k x 6 the nj bait. The form includes Schedule PTE-K-1 which reports the income and tax credit for each owner. March 15 2022 Update.

A national trend ensuing the Tax Cuts and Jobs Act TCJA has been states attempts to circumvent the 10000 state and local tax SALT deduction limitation. Landfill Closure and Contingency Tax. New Jersey Apportionment For tax year 2021 S corporations calculating their BAIT tax base may use either the default apportionment method for S corporations which is a single-sales.

Governor Murphy signed into law a bipartisan bill S4068 that enhances the states electable pass-through entity PTE tax known as the New Jersey Business Alternative Income Tax BAIT on January 18 2022.

Tax Alert Faqs Released On Business Alternative Income Tax Bait Sax Llp Advisory Audit And Accounting

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

State Of Nj Department Of The Treasury Division Of Taxation

The Nj Pass Through Business Alternative Income Tax Act Alloy Silverstein

Accounting New Jersey Business Industry Association

New Jersey State Tax Information Support

Waiver Of Right Of First Refusal Condo Form Fill Online Printable Fillable Blank Pdffiller

Why Nj Businesses Should Take The Bait New Jersey Business Magazine

Corporation Business Tax Login

Applicability Of Charitable Deductions For Estates And Trusts Marcum Llp Accountants And Advisors

Why Nj Businesses Should Take The Bait New Jersey Business Magazine

N J Department Of Treasury Division Of Taxation On Line Filing

Nj Salt Work Around Pass Through Entity Tax

The Pass Through Entity Workaround To Beat The Salt Limitation Certified Tax Coach

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors